As a buyer or a seller, the appraisal is one of the key parts in the home sale transaction. If you’re the buyer, you have to get an appraisal to get a loan. As a home seller, one of the key stumbling blocks on the sale is having the home appraise for the selling price. What happens when the home does NOT appraise for at least the agreed upon sales price? Are there any options? [Read more…]

I’m A Frustrated Home Buyer! What Do I Do In Today’s Market?

Spring/Summer of 2013 is turning into one of the most frustrating home buying seasons for buyers. Low interest rates, super low housing inventory, and incredibly hyped media reports are making it hard for willing buyers to successfully get into contract on a home. If you’re frustrated at the whole process, and believe your current efforts are futile, I have a few suggestions. These tips are no guarantee you will be successful, but it will help you be competitive on all of your offers. [Read more…]

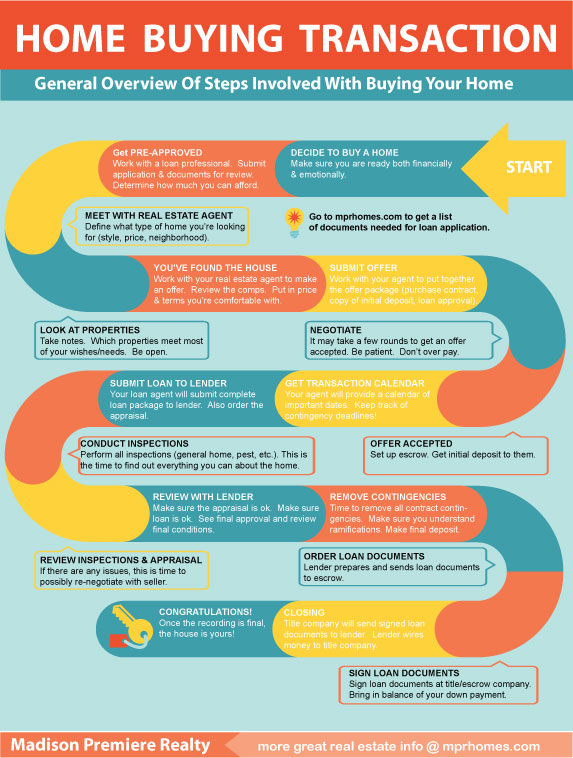

MPR Infographic: Home Buying Process

We love infographics here at MPR. Actually, who doesn’t love infograpics. Our crack marketing department decide to take a stab at our very own. Here’s a graphical representation of the home buying process. The steps may be a little different in various part of the country. However, it provides a nice, general flow of the process. We would love your feedback!

When Do I Have To Actually Spend Money During The Home Buying Process?

Most people have a general idea on the expenses associated with buying a home. However, they have no clue on when they are going to have to actually “dish” out the money. Let’s lay it out. [Read more…]

What Is Included In Your Offer To Buy A House?

You’ve found a property that you really love and are excited about. It’s time to put your best foot forward and submit an offer. Here are the elements that go into your offer package. [Read more…]

Should You Make An Offer On A Property Without Ever Seeing The Inside?

As of the initial writing of this post (Spring 2013), the housing market in the San Francisco Bay Area can be summed up in one word… “BANANAS”! There is a real shortage of available homes for sale. The problem is there isn’t a shortage of buyers looking for homes. [Read more…]

Should You Buy A Home That Is Tenant Occupied In San Francisco?

The San Francisco housing market has, and will always be a somewhat tenacious beast. Often times you have competing interests that create an overly complicated environment. Case in point, the immensely complicated world of tenant’s rights laws in San Francisco. [Read more…]

The Cost of FHA Loans Going Up On April 1st & June 3rd 2013

FHA loans are a great way for some home buyers to get into a property with a low down payment, a good rate, and a higher debt to income ratio. The FHA loan program will be changing on April 1st, 2013 and June 3rd, 2013.

On all FHA loans with case numbers ordered on or after 04/01/2013, the monthly mortgage insurance premium (MIP) will increase by .10 for loan amounts under $625k.

| Loan Term,LTV(%),Previous MIP Rate,New MIP Rate | |

|---|---|

| Greater than 15yr term,down payment < | 5%,1.25%,1.35% |

| Greater than 15yr term,down payment 5%-9%,1.20%,1.30% | |

| Greater than 15yr term,down payment 10%-21%,1.20%,1.30% |

On 06/03/2013, the length required to have monthly mortgage insurance is changing.

| Loan Term,LTV(%),Previous MIP Duration,New MIP Duration | ||

|---|---|---|

| Less than or equal to 15 years,Less than or equal to 78%,5 years,11 years | ||

| Less than or equal to 15 years,Greater than 78% – | 90%,Cancelled at 78% LTV,11 years | |

| Less than or equal to 15 years,Greater than 90%,Cancelled at 78% LTV,Loan term | ||

| Greater than 15 years,Less than or equal to 78%,5 years,11 years | ||

| Greater than 15 years,Greater than 78% – | 90%,Cancelled at 78% LTV & | 5 years,11 years |

| Greater than 15 years,Greater than 90%,Cancelled at 78% LTV & | 5 years,Loan term |

What You Need To Know:

[checklist]

- Even with the increases, a FHA loan is still a great option. You just have to look at the numbers to make sure it works for you.

- Look at conventional loan products as an alternative. There are major banks who provide loans with high LTV’s.

- Consider delaying your home purchase until you can put a larger down payment.

[/checklist]

Are You Grown Up Enough To Buy A House

You’re getting the itch to buy a home. You might have come to this decision based on any number of reasons… all your friends and co-workers are buying homes, your parents are telling you to buy your own place, or you might be thinking of starting your family in your own home. Whatever the reason, in addition to being financially ready to buy, you need to have the right mindset [Read more…]

MPR Video: Why It’s Important To Determine Your Home Buying Budget

Want to start your home buying journey on the wrong foot? I didn’t think so. Then before you even consider looking at homes, you need to figure out how much you can afford to spend on the purchase. This video outlines why you need to figure out home home buying budget.

[youtube id=”n44ZbwnSMnQ” width=”420″ height=”315″]